On September 24, 2021, the latest issue of Drug Discovery Today magazine recently published a paper entitled R & D efficiency of leading pharmaceutical companies-a 20-year analysis, analyzed the R & D data of 14 leading global drug R & D enterprises, and revealed some laws of drug R & D investment and output, which is quite enlightening to the industry.

This article reviews 14 major pharmaceutical companies’ financial data from 1999 to 2018, 270 new molecular entities (NMEs) and more than 160,000 data; the analysis shows that over the past 20 years:

40% of new molecular entities (NMEs) originate from patent research, 41% from mergers and acquisitions, and 19% from drug licensing: this shows the important role of external innovation in the pharmaceutical industry;

There is an approximately linear correlation between R&D investment and R&D output: the more a company invests in R&D, the higher its cumulative impact factor in the number of NMEs and publications;

Pharmaceutical companies require an average of 16,315 R&D personnel to generate 25 NMEs; model analysis suggests that for every 5 additional NMEs in R&D output, an additional 3,039 R&D personnel will be required, while the next 5 NMEs will require an additional 2,570 R&D personnel.

The pharmaceutical sector is highly dependent on innovative growth. Across the industry, the high expenditure and risk of research and development (R&D) requires efficient use of R&D resources to develop as many meaningful new molecular entities as possible, allowing companies to remain innovative and competitive.

Typically, R&D efficiency is measured by dividing R&D input (cost or number of people) by R&D output (usually expressed as NME approvals), or using the number of scientific publications and patent applications to measure R&D output.

In recent decades, the challenges and complexities of pharmaceutical R&D have led to a decline in R&D efficiency within the pharmaceutical industry, known as “Eroom’s Law”. In this context, we conducted a qualitative and quantitative comparative analysis of 14 major pharmaceutical companies to identify success factors in R&D efficiency.

Data Sources

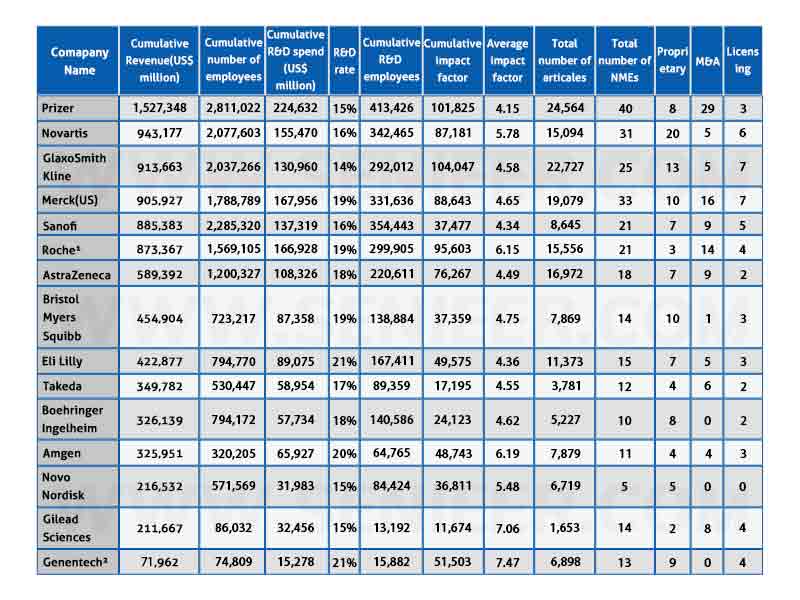

The dataset includes financial, drug output, and publication data for 20 major pharmaceutical companies (determined by total drug sales in 2018) from 1999 to 2018 (Table 1). Six companies including Johnson & Johnson, Bayer, Abavi, Merck KgaA, Teva and Allergan were excluded due to their different business models and uneven datasets.

Table 1: Key R&D Indicators for Major Pharmaceutical Companies (1999-2018)

R&D Expenses And New Drug Approvals

From 1999 to 2018, R&D investment by the 14 major pharmaceutical companies grew steadily in absolute terms, from $49.2 billion in 1999 to $87.1 billion in 2008. Expressed as a percentage of revenue (i.e. R&D rate), it has grown from 14% in 1999 to 19% in 2018.

14 leading pharmaceutical companies launched 270 (45%) of the 602 NMEs approved across the industry. In at least 4 of the past 20 years, a total of 7-9 of all 14 companies have been approved, suggesting that some companies have consistently low R&D output.

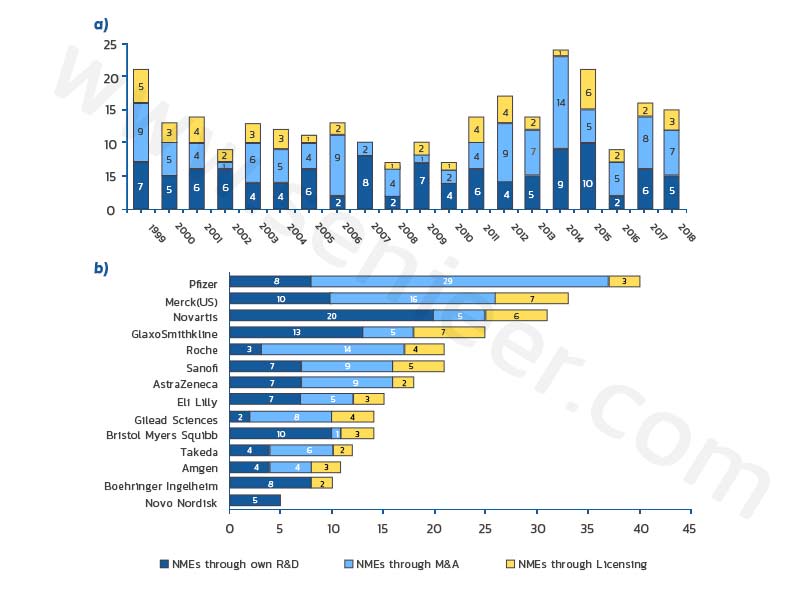

The most important sources of new molecular entities (NMEs) (Figure 1a) were patent research (40%), M&A activity (41%), and drug licensing (19%), indicating the importance of external innovation in the industry. Regarding the relative contributions of the three sources of innovation, the data for the four companies show different R&D patterns (Figure 1b): Pfizer and Roche have respectively 73% and 86% of their NMEs from acquisitions or licenses; while Most of the NMEs of Bristol-Myers Squibb and Novartis (71% and 65%, respectively) are independently developed.

Figure 1: Sources of New Molecular Entities (NMEs) for major pharmaceutical companies during the reporting period

1999 to 2018: (a) 14 major companies; (b) individual companies.

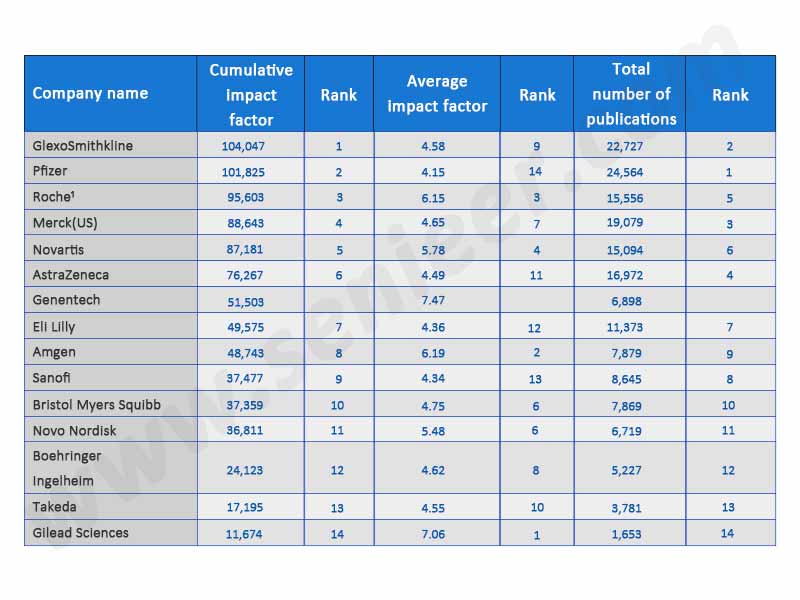

Scientific Publications

From 1999 to 2018, 14 leading pharmaceutical companies published a total of 167,138 scientific papers. In terms of volume, Pfizer, GlaxoSmithKline, and Merck & Co. had the highest number of publications (22,727, 24,564, and 19,079, respectively).

Sorted by average impact factor, the three leading companies are Genentech (7.47), Gilead (7.06) and Amgen (6.19). The three companies with the highest cumulative impact factor (i.e. the product of the average impact factor multiplied by the number of publications) are GlaxoSmithKline (104047), Pfizer (101825) and Roche (95603) (Table 2).

NME Approval And Scientific Publication Efficiency

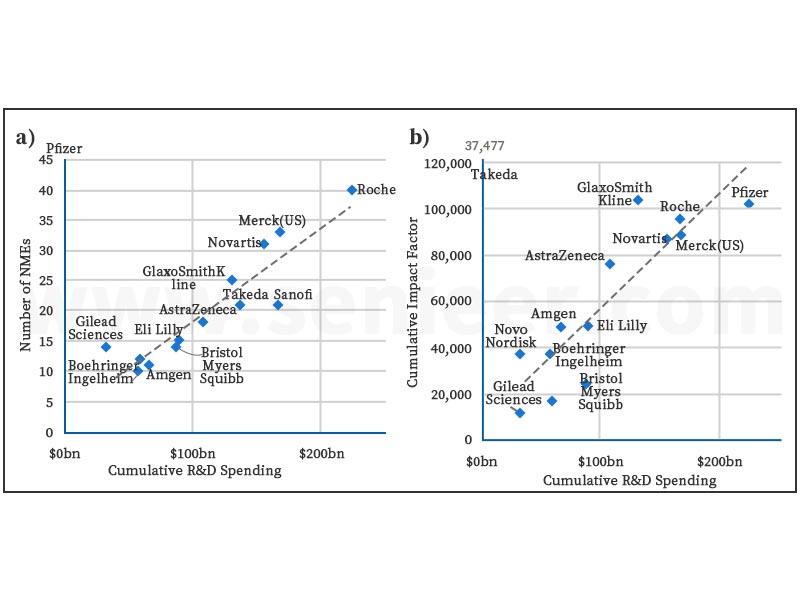

We find an almost linear relationship between R&D expenditure and the output parameter. The more a company has invested in R&D over the past 20 years, the higher its output (expressed as an approved NME or cumulative impact factor).

Pfizer, Merck & Co., Novartis, GSK, and Gilead Sciences all outperformed their peers in NME output, demonstrating that their R&D resources are being used effectively use. Companies above the trend line in Figure 2 appear to have outperformed those below the trend line over the past 20 years.

Novartis and GlaxoSmithKline’s majority of their NMEs come from patent programs, further cementing their image as R&D engines, while Pfizer, Merck and Gilead Technologies appear to be effectively capitalizing on their intensive M&A and licensing activities.

Figure 2: R&D Efficiency Regression Estimated According to (a) Number of NMEs and (b) Cumulative Influencing Factors

R&D Scale And Efficiency

The number of R&D personnel usually has the greatest impact on R&D costs, and we correlate the number of NMEs approved with the average number of employees (Figure 3) and find that pharmaceutical companies require an average of 16,315 R&D personnel to generate 25 NMEs; The 5 NME R&D outputs will require an additional 3039 R&D personnel, while the next 5 NMEs will require an additional 2570 R&D personnel.

This suggests that there is indeed an economic R&D scale: pharmaceutical companies can benefit from large R&D facilities. Pfizer, Merck, Novartis, GSK, and Gilead Sciences appear to be using R&D scale more effectively than their peers. Possible reasons for increased R&D efficiency are: lower cost of capital, greater portfolio diversity, better use of R&D techniques, tacit knowledge aggregation, learning from past successes, greater data ownership, better access to real data Wait.

Global New Drug Approvals To Reach Highest In 2021

The research and development of new drugs is a high-tech industry with large investment, long cycle, high risk and high return. There are generally five stages. Development of research plans and preparation of new compounds, drug preclinical research, drug clinical research, drug application and approval, and new drug monitoring.

New drug research and development is an important driving factor for the development of the global pharmaceutical industry, which is of great significance to human health and life safety. Since the 21st century, pharmaceutical companies have continuously increased their investment in drug research and development. According to statistics, from 2001 to 2019, the number of new drugs under research in the world maintained a steady growth trend. In 2001, the number of new drugs under research in the world was 5,995, and by 2019, it had increased to 16,181, which was 2.7 times that of 2001. With the outbreak of the new crown epidemic, the pharmaceutical industry has been encouraged. The China Business Industry Research Institute predicts that the number of new drugs under research in the world will reach 17,734 in 2021.

In addition, the U.S. FDA has accelerated the speed of drug review, so that pharmaceutical companies are expected to enjoy the return of drugs after listing, and also promote the enthusiasm of pharmaceutical companies for R&D investment. According to the FDA’s annual report on new drug approvals, the number of new drugs approved by the US FDA each year remained relatively stable from 2001 to 2010, while the number of new drugs approved by the US FDA has increased rapidly in recent years. In 2020, a total of 67 innovative drugs were approved, including 51 New Molecular Entities (NMEs), reaching an all-time high.

In recent years, a series of support policies in the field of innovative drugs have been released internationally, such as the reform of chemical drug registration classification, the pilot of the marketing authorization holder system, the priority review of innovative drugs, patent compensation, and drug trial data protection. Policy barriers to new drug research and development have accelerated the pace of new drug research and development. Innovative drugs and innovative technologies have become a hot spot for industrial capital to pursue, and many new drug R&D companies have gone public, providing important capital support for new drug R&D.

Innovation Creates Schumpeter Rent, And China Enters The Era Of Innovative Drugs

The demand elasticity is small, and innovative drugs bring returns on investment. The pharmaceutical industry is an industry that integrates multidisciplinary cutting-edge scientific research progress and advanced technology. Since the outbreak of the global financial crisis in 2008, the world economic growth has continued to slow down, but the pharmaceutical industry has maintained stable capital investment. Pfizer, Novartis, Merck and other global top 10 pharmaceutical companies have always maintained their R & D share at about 20%.

Although they face high innovation costs, due to the low elasticity of demand for specific drugs and high pricing sales, these large pharmaceutical companies are in direct proportion to their investment and returns. It is the high emphasis on innovation that allows pharmaceutical giants to obtain Schumpeter rents by virtue of the competitiveness of their products, which in turn brings returns on investment.

Global innovative drugs have entered a new era, and China is late but has a strong momentum. The world’s modern pharmaceutical industry originated in the middle of the 19th century, and today’s pharmaceutical giants were still chemical factories and dye factories at that time. Since then, the application of synthetic chemistry and pharmacology has made the pharmaceutical industry develop by leaps and bounds.

The early 1900s to the 1970s were a booming era for the pharmaceutical industry. Subsequently, the theory of human biochemical processes continued to develop, and biotechnology became an indispensable and important part of the pharmaceutical industry. Biotechnology companies such as Amgen and Genentech became new giants. Recently, biomedicine has been gradually transformed into a data-intensive science, promoting the development of medical treatment to new drug paradigms such as gene therapy, precision medicine and personalized medicine.

The development of China’s pharmaceutical industry is relatively late, and the Chinese market was occupied by generic drugs in the past. In recent years, the pharmaceutical industry has set off a wave of innovation, and capital is inclined to innovation. At present, China’s first-generation innovative drugs are mainly based on “Fast-follow”; some companies have achieved results by expanding new indications and combination therapies on the basis of original indications, and entered Innovation 2.0; leading companies have begun to explore new targets and carry out original innovations, leading China into the era of Innovation 3.0.

The iteration of the pharmaceutical industry is accelerated, new tracks are constantly being created, and structural changes are prominent. In the past 20 years, modern biotechnology represented by genetic engineering and cell engineering has developed rapidly, and breakthroughs have been made in major technologies such as the Human Genome Project. As the most traditional drug paradigm, chemical drugs have a history of more than 100 years. The representative drug aspirin was launched in 1899.

After a hundred years of development and exploration, many chemical drugs for diseases cannot be made into medicines. Recombinant genetic engineering drugs were launched in 1982, creating the era of biological macromolecular drugs and bringing us some of the most important drugs in the past 40 years, such as recombinant human insulin, tumor immunotherapy drug PD-1, and now the “King of Medicine” Humira Wait.

With the internal iteration of chemical drugs and biological macromolecular drugs, the era of gene therapy has begun, and China is synchronized with the world. Extending the time dimension of drug R&D progress, chemical drugs and biological macromolecular drugs can still develop new drugs through new drug discovery, construction and other technologies, but standing today and looking forward to the next 10 years, gene and cell therapy will emerge.

Represented by the approval of two CAR-T products by the US FDA in 2017, the era of gene therapy has arrived. The birth of the mRNA Covid-19 vaccine in 2020 is also a commercialization milestone for a new drug paradigm. Based on estimates of the progress and success rate of existing clinical trials, the FDA will approve 10-20 gene and cell therapies per year starting in 2025. In this field, Chinese companies develop almost simultaneously with the world, leaving Chinese companies an excellent window to enter the global innovative drug market.

Conclusion And Outlook

The results of the analysis show that the R&D efficiency of the 14 leading pharmaceutical companies assessed appears to have declined over the past 20 years; however, the 14 pharmaceutical companies still launch half of the market with new compound entities, showing that these companies have 20 years of dominance in the industry. And a significant portion of their NMEs is acquired through M&A and licensing, showing Big Pharma’s growing reliance on external innovation.

Our analysis revealed that higher R&D investment was associated with higher R&D output; companies with more than 14,000 R&D employees were able to generate higher R&D output than that predicted by a linear function. Our analysis of 20 years of R&D efficiency at leading pharmaceutical companies shows that there is a “scale effect” in pharmaceutical R&D: large R&D institutions benefit from their scale to increase output and tend to be more efficient and competitive than smaller companies.

Finally, top companies have the ability to leverage large M&A deals or long-term funds to become a large, efficient R&D organization. Smaller companies in the third tier typically have limited R&D budgets and scale, and need to adopt strategies that can stay competitive. Mid-sized pharmaceutical companies have the opportunity to capitalize at scale to compete with the largest companies in the industry, and they have the agility and flexibility to quickly adapt to market trends, allowing them to fully benefit from R&D opportunities. They also avoid the high strategic risks of mergers and acquisitions that some leading pharmaceutical companies must take to remain competitive.